The Ultimate Guide To Clark Wealth Partners

Table of ContentsClark Wealth Partners Things To Know Before You Get ThisThe 2-Minute Rule for Clark Wealth PartnersThe Ultimate Guide To Clark Wealth PartnersClark Wealth Partners - TruthsClark Wealth Partners - An OverviewThe Best Strategy To Use For Clark Wealth PartnersGetting My Clark Wealth Partners To Work

These are specialists who offer investment guidance and are registered with the SEC or their state's safeties regulatory authority. Financial consultants can likewise specialize, such as in student lendings, senior demands, tax obligations, insurance coverage and various other elements of your funds.Only financial consultants whose classification needs a fiduciary dutylike licensed financial planners, for instancecan claim the very same. This distinction additionally indicates that fiduciary and financial expert fee frameworks vary also.

Our Clark Wealth Partners Diaries

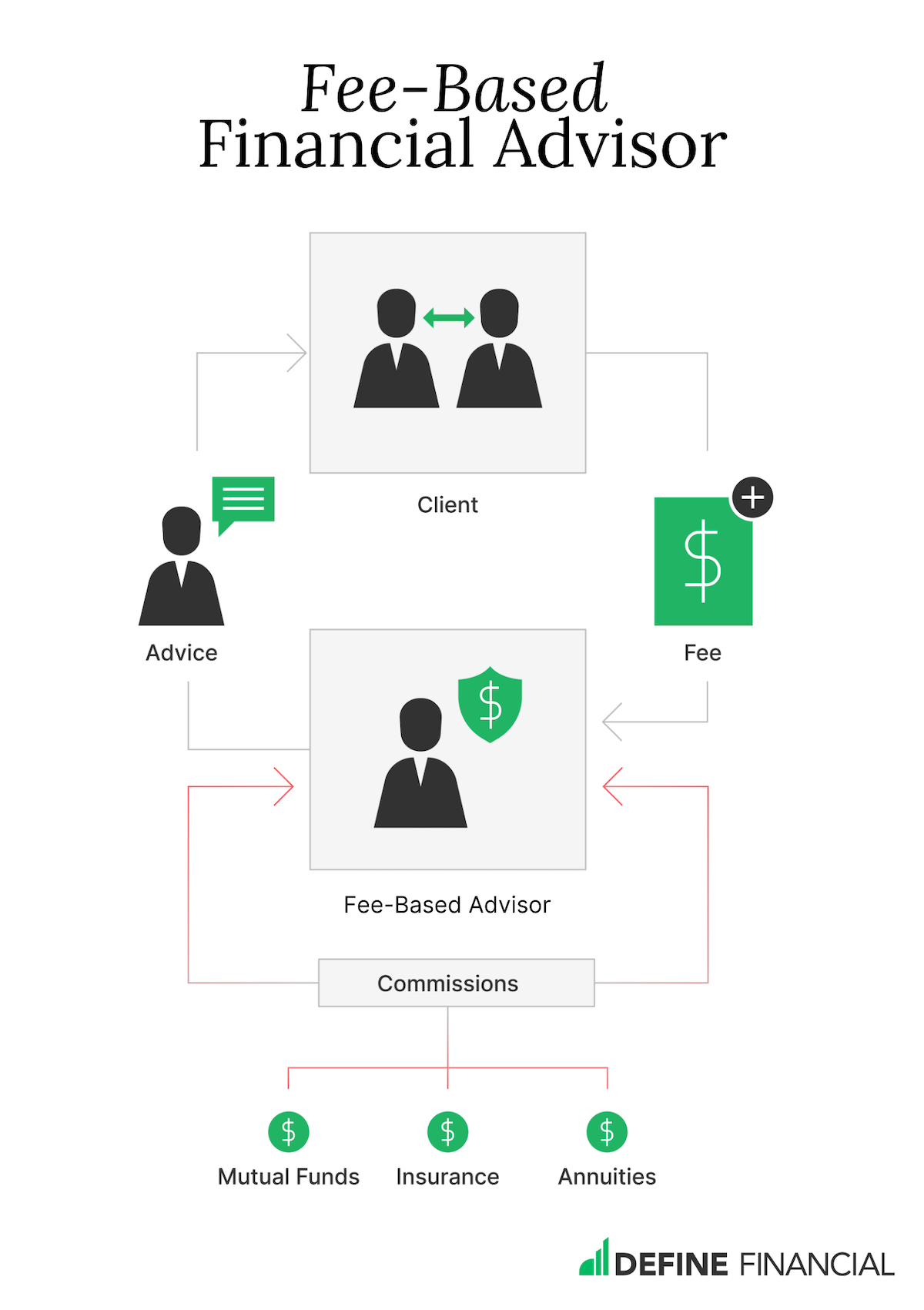

If they are fee-only, they're more probable to be a fiduciary. If they're commission-only or fee-based (indicating they're paid using a combination of fees and compensations), they could not be. Many credentials and designations need a fiduciary obligation. You can check to see if the professional is registered with the SEC.

.jpeg?width=386&height=338&name=6%20Money%20Decisions%20Graphic%20(R).jpeg)

Selecting a fiduciary will certainly guarantee you aren't steered toward specific financial investments due to the compensation they use - financial planner in ofallon illinois. With great deals of money on the line, you may want a monetary expert that is lawfully bound to make use of those funds thoroughly and just in your benefits. Non-fiduciaries may advise investment products that are best for their pocketbooks and not your investing objectives

Getting My Clark Wealth Partners To Work

Find out more currently on how to keep your life and financial savings in equilibrium. Boost in savings the typical house saw that collaborated with a monetary advisor for 15 years or even more compared to a comparable family without a financial expert. Source: Claude Montmarquette & Alexandre Prud'homme, 2020. "A lot more on the Value of Financial Advisors," CIRANO Task Information 2020rp-04, CIRANO.

Financial guidance can be valuable at turning factors in your life. Like when you're beginning a household, being retrenched, intending for retirement or taking care of an inheritance. When you meet with a consultant for the very first time, exercise what you wish to get from the suggestions. Before they make any type of recommendations, a consultant should make the effort to review what's important to you.

The Best Guide To Clark Wealth Partners

Once you have actually concurred to go in advance, your financial consultant will prepare a monetary plan for you. You ought to constantly feel comfy with your advisor and their guidance.

Firmly insist that you are notified of all transactions, which you obtain all document pertaining to the account. Your consultant might suggest discover this info here a managed optional account (MDA) as a means of managing your investments. This entails authorizing a contract (MDA contract) so they can acquire or offer investments without needing to inspect with you.

Get This Report on Clark Wealth Partners

To safeguard your cash: Don't offer your adviser power of lawyer. Insist all document about your financial investments are sent to you, not simply your adviser.

This might take place during the meeting or online. When you get in or restore the continuous cost plan with your advisor, they must define how to end your partnership with them. If you're transferring to a new advisor, you'll require to arrange to move your monetary records to them. If you require help, ask your consultant to discuss the process.

will retire over the following decade. To fill their shoes, the nation will certainly require greater than 100,000 new monetary advisors to enter the industry. In their everyday job, economic advisors take care of both technological and imaginative jobs. United State News and World Record placed the function among the leading 20 Finest Company Jobs.

The Buzz on Clark Wealth Partners

Helping people accomplish their economic objectives is a monetary expert's main feature. Yet they are likewise a little service proprietor, and a section of their time is committed to handling their branch workplace. As the leader of their technique, Edward Jones financial advisors need the management abilities to employ and manage personnel, in addition to the organization acumen to create and implement an organization technique.

Spending is not a "set it and neglect it" activity.

Financial experts need to schedule time each week to fulfill new individuals and capture up with the people in their round. Edward Jones monetary consultants are privileged the home workplace does the hefty lifting for them.

The 4-Minute Rule for Clark Wealth Partners

Proceeding education and learning is a needed component of preserving a financial advisor certificate (retirement planning scott afb il). Edward Jones economic consultants are encouraged to pursue added training to expand their knowledge and abilities. Commitment to education and learning protected Edward Jones the No. 17 spot on the 2024 Educating APEX Honors listing by Educating publication. It's also an excellent idea for economic consultants to participate in market conferences.